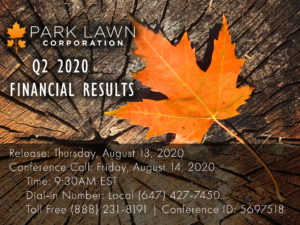

Park Lawn Q2 2020 Financial Results Released on Thursday, August 13, 2020 and Earnings Conference Call on Friday, August 14, 2020 at 9:30 am (EST)

TORONTO, ONTARIO – (July 31, 2020) – Park Lawn Corporation (TSX: PLC) (“PLC”) announced today that it will release its Q2 financial results for 2020 on Thursday August 13, 2020. PLC will host a conference call at 9:30 am (EST) on Friday August 14, 2020 to discuss its Q2 2020 financial results. Details of the conference call are as follows: Date: Friday, August 14, 2020 Time: 9:30am EST Dial-in Number: Local (647) 427-7450 | Toll Free (888) 231-8191 | Conference ID: 5697518 To ensure your participation, please join approximately five minutes prior to the scheduled start of the conference call. About Park Lawn Corporation PLC provides goods and services associated with the disposition and memorialization of human remains. Products and services