TORONTO, ONTARIO (March 2, 2023) – Today, Park Lawn Corporation (TSX: PLC; PLC.U) (“PLC”, “Park Lawn”, or the “Company”) announced its financial operating results for the fourth quarter (“Q4”) and year ended December 31, 2022.

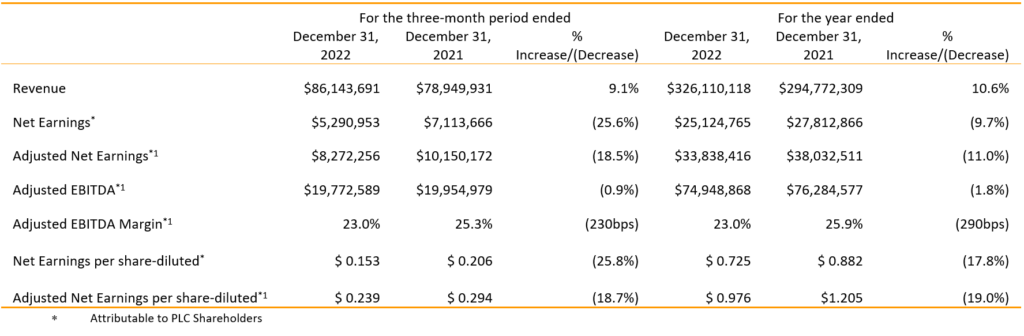

Financial Results from Q4 and the Year Ended 2022

J. Bradley Green, Chief Executive Officer of PLC commented, “We are pleased with our fourth quarter 2022 year-end operating results as compared to the heavily COVID-19 impacted fourth quarter and year-end 2021. While the Centers for Disease Control and Prevention identified a sharp decline in the U.S. national death during the year, our decrease in call volume was notably less than the national decline, as well as that of our peers. Further, as we experienced this change in landscape in conjunction with an inflationary and challenging macroeconomic climate, we were able to quickly adjust our operations in the short-term and are proud of how this is illustrated by our fourth quarter results. For example, we saw our same store funeral averages increase quarter-over-quarter by 1.3% despite increased inflationary pressures. Likewise, we saw an increase in our Adjusted EBITDA margin of 240 basis points from the second quarter of this year, far exceeding our own expectations to make meaningful change in this short period. This significant improvement would not have been possible without the visibility provided by our proprietary software system FaCTS™ and the hard work of our employees. We remain committed to regularly improving upon and refining our operations to maximize shareholder value.”

Key Results from Q4 and the Year Ended 2022

- For the three-month period and year ended December 31, 2022, revenue grew by approximately 9.1% and 10.6%, respectively, over the comparable prior period, primarily due to acquisitions made during 2022 and 2021.

- For the three-month period and year ended December 31, 2022, revenue from Comparable Operations decreased only slightly at 2.0% and 2.3% respectively, far outperforming decreases in mortality rates.

- Fully Diluted Earnings per share attributable to PLC shareholders was $0.153 and $0.725 for the three-month period and year ended December 31, 2022, respectively, compared to $0.206 and $0.882 for the three-month period and year ended December 31, 2021, respectively.

- Adjusted Net Earnings per share attributable to PLC shareholders was $0.239 and $0.976 for the three-month period and year ended December 31, 2022, respectively, compared to $0.294 and $1.205 for the three-month period and year ended December 31, 2021, respectively.

- For the three-month period ended December 31, 2022, Net Earnings decreased 25.6% relative to the three-month period ended December 31, 2021 and decreased 9.7% over the year ended December 31, 2021.

- For the three-month period ended December 31, 2022, Adjusted EBITDA was consistent with the three-month period ended December 31, 2021, and decreased 1.8% over the year ended December 31, 2021.

- PLC achieved an Adjusted EBITDA margin of 23.0% for the three-month period and year ended December 31, 2022, respectively.

PLC Achieved its 2022 Aspirational Growth Target

In 2018, PLC announced a long-term aspirational goal of achieving CAD$100 million in pro forma Adjusted EBITDA[2] by the conclusion of the 2022 calendar year. The Company is proud to announce that it exceeded this aspirational growth target at the conclusion of 2022.

In response to the Company meeting this goal, Mr. Green stated, “Despite the many adverse conditions experienced during the five year period, including the COVID-19 pandemic as well as the subsequent periods since its height, we are pleased that the Company not only met, but exceeded its aspirational growth target. We look forward to further sharpening our operating acumen as we turn our focus to the achievement of our previously announced 2026 aspirational growth targets.”

PLC Remains Committed to its Comprehensive Growth Strategy

Subsequent to the quarter, the Company announced it has entered into a definitive agreement to acquire substantially all of the assets of Carson-Speaks Chapel in Independence, Missouri; Speaks Buckner Chapel in Buckner, Missouri; Speaks Suburban Chapel in Independence, Missouri; and Oak Ridge Memory Gardens in Independence, Missouri, a group of businesses consisting of three stand-alone funeral homes and one stand-alone cemetery. The transaction is anticipated to close in early April 2023 following the receipt of regulatory approval.

Important Reminder

The Company will host a conference call to discuss its fourth quarter 2022 financial results on Friday, March 3, 2023. Details are as follows:

- Date: Friday, March 3, 2023

- Time: 9:30 a.m. EST

- Dial-in Number: Toll Free (888) 506-0062 | Conference ID: 934271

To ensure your participation, please join approximately five minutes prior to the scheduled start of the conference call. The Company’s complete financial results can be found at www.sedar.com or on the Company’s website at www.parklawncorp.com.

A replay of the conference call will be available until Friday, March 17, 2023 and can be accessed as follows: Dial-in Number: Toll Free (877) 481-4010| Conference ID: 47713. Alternatively, the conference will also be available on the Company’s website at www.parklawncorp.com.

About Park Lawn Corporation

PLC provides goods and services associated with the disposition and memorialization of human remains. Products and services are sold on a pre-planned basis (pre-need) or at the time of a death (at-need). PLC and its subsidiaries own and operate businesses including cemeteries, crematoria, funeral homes, chapels, planning offices and a transfer service. PLC operates in two Canadian provinces and eighteen U.S. states.

Non‐IFRS Measures

Adjusted Net Earnings, Adjusted EBITDA and their related per share amounts, Adjusted EBITDA margins, Acquired Operations and Comparable Operations are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS. Such measures are presented in this news release because management of PLC believes that such measures are relevant in evaluating PLC’s operating performance. Such measures, as computed by PLC, may differ from similar computations as reported by other similar organizations and, accordingly, may not be comparable to similar measures reported by such other organizations.

The Company defines Acquired Operations as business units or operating locations acquired by the Company during the period from January 1, 2021 and ending December 31, 2022. The Company defines Comparable Operations as business units or operating locations owned by the Company for the entire period from January 1, 2021 and ending December 31, 2022.

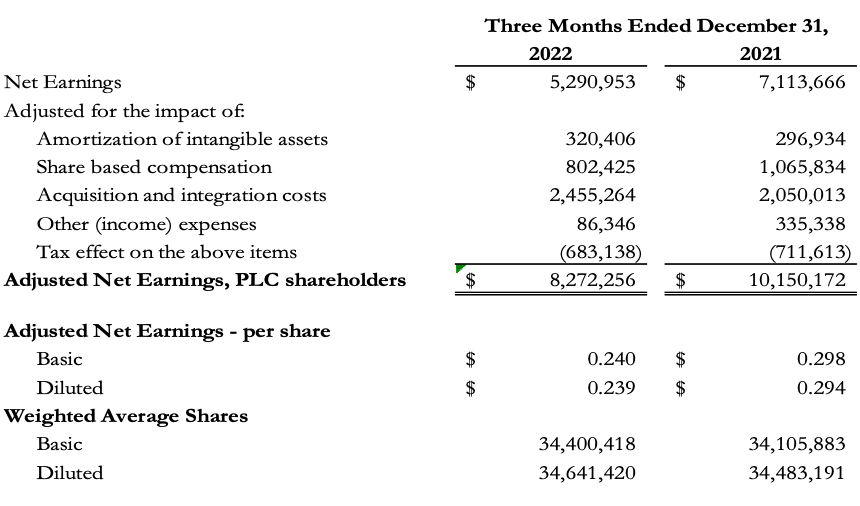

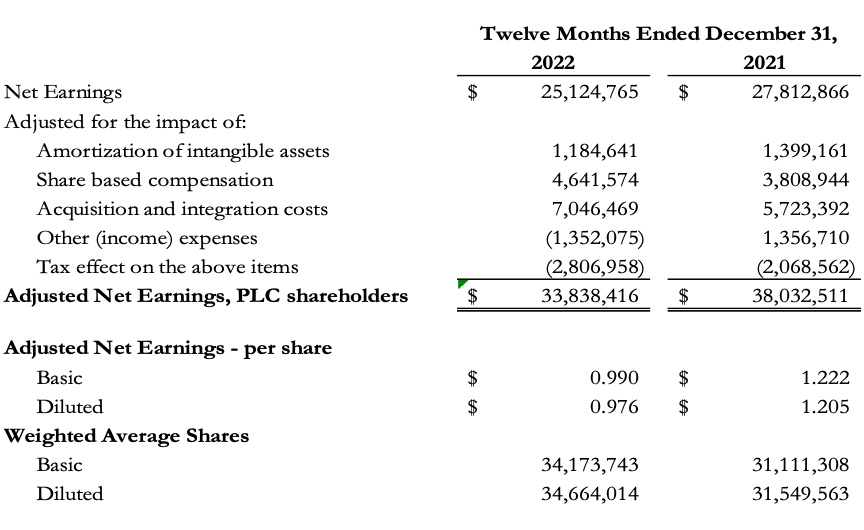

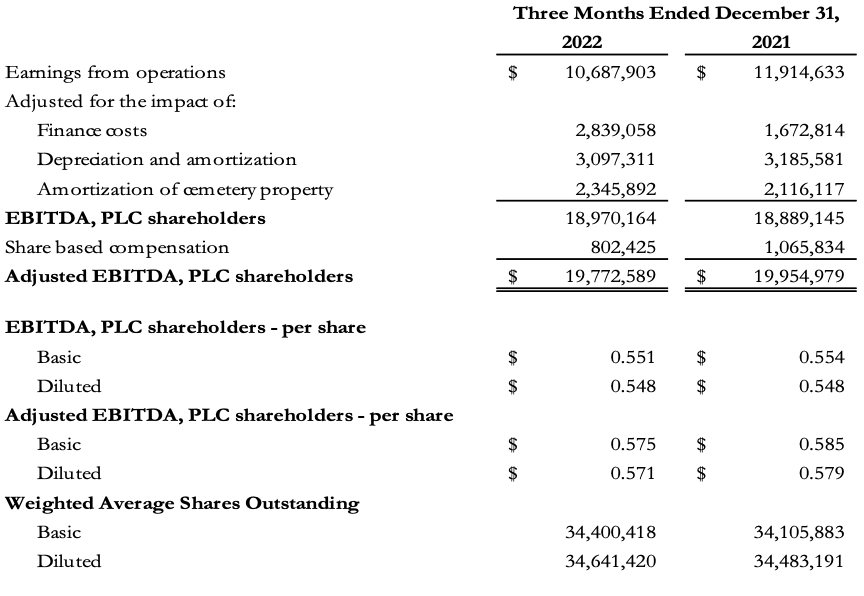

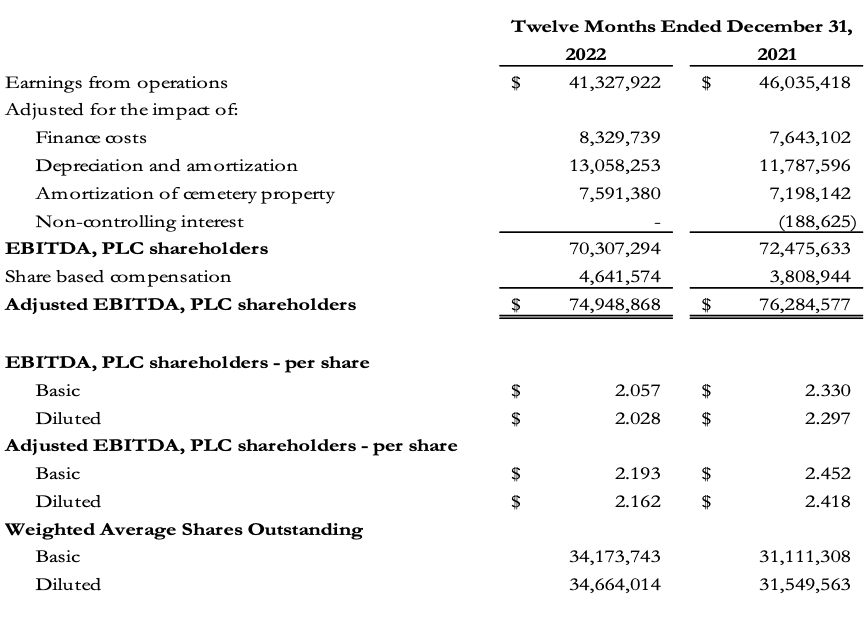

The following tables indicate how the Company reconciles Adjusted Net Earnings, Adjusted EBITDA and their related per share amount, and Adjusted EBITDA margins to the nearest IFRS measure.

Adjusted Net Earnings

EBITDA and Adjusted EBITDA

Cautionary Statement Regarding Forward‐Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws relating to the business of PLC and the environment in which it operates. Forward-looking statements are identified by words such as “believe”, “anticipate”, “aspirational”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “estimate”, “pro-forma” and other similar expressions. These statements are based on PLC’s expectations, estimates, forecasts and projections and include, without limitation, statements regarding: PLC’s expectations regarding the achievement of its previously announced 2026 aspirational growth targets; PLC’s expectations regarding the important role that Westminster Funeral & Reception Centre and Waco Memorial Funeral Home will play in PLC’s organic growth strategy; and PLC’s expectation that the Speaks acquisition will close in early April 2023. The forward-looking statements in this news release are based on certain assumptions, including the assumed improvement in the COVID-19 pandemic and the normalization of the death rate, that the CAD to USD exchange rate remains consistent, PLC will continue to execute on its organic growth strategy; PLC is able to obtain regulatory approval or satisfy regulatory requirements for the Speaks acquisition, the Speaks acquisition closes in the anticipated timeframe, the Speaks acquisition and the other recently completed acquisitions referred to in this press release will perform as expected, PLC will be able to implement business improvements and costs savings, PLC will be able to retain key personnel, there will be no unexpected expenses occurring as a result of contemplated acquisitions, multiples remain at or below levels paid by PLC for previously announced acquisitions, the acquisition and financing markets remain accessible, capital can be obtained at reasonable costs and PLC’s current business lines operate and obtain synergies as expected, as well as those regarding present and future business strategies, the environment in which PLC will operate in the future, expected revenues, expansion plans and PLC’s ability to achieve its aspirational goals and acquisitions targets.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, risks associated with the future impacts of the COVID-19 pandemic, as well as other pandemic, epidemic and health risks, risks associated with the impact of inflation on PLC’s business, risks associated with the conflict between Russia and Ukraine, including from economic sanctions imposed or to be imposed as a result thereof, and supply chain disruptions resulting therefrom, and the other factors discussed under the heading “Risk Factors” in PLC’s most recent Annual Information Form and most recent Management’s Discussion and Analysis available at www.sedar.com. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, PLC assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Contact Information

Daniel Millett

Chief Financial Officer

(416) 231-1462, ext. 221

[1] Adjusted Net Earnings, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Earnings per share-diluted are non-IFRS financial measures. Refer to the non-IFRS Financial Measures section of this document for more information on each non-IFRS financial measure.

[2] For purposes of the 2022 Aspirational Growth Target, pro forma Adjusted EBITDA means EBITDA adjusted as if the businesses acquired during the 2022 calendar year were made as of January 1, 2022.