Marching Closer to the Achievement of its 2022 Goals

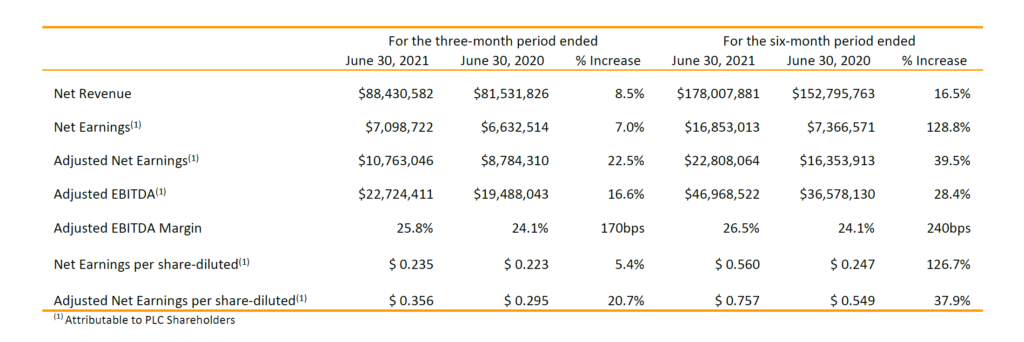

TORONTO, ONTARIO (August 12, 2021) – Today, Park Lawn Corporation (TSX: PLC) (“PLC” or the “Company”) announced its results for the second quarter (“Q2”) ended June 30, 2021. Through both its growth and integration initiatives, PLC continues to improve quarter-over-quarter resulting in an impressive Q2 2021 performance. The Company experienced growth in revenue, net earnings, Adjusted Net Earnings, Adjusted EBITDA, and Adjusted EBITDA margin:

J. Bradley Green, Chief Executive Officer of PLC, stated:

“After a strong second quarter, we have solidified an impressive first half to 2021. Even with the anticipated lessening effect of COVID-19 on the at-need volume of our comparable businesses, we saw the total funeral home call volume increase quarter-over-quarter driven by both our acquisitions and continued improvements in operating performance. Additionally, similar to what we observed in the first quarter, we continued to see an increase in demand for both pre-need cemetery and pre-need funeral products including property, services and merchandise. Moreover, we also were able to sustain an increase in our averages per contract resulting in an all-around solid quarter-over-quarter performance.

Moving forward, while we believe that these normalizing trends will continue into the third and fourth quarters of 2021, we continue to expect financial growth over 2020 for the same reasons we experienced growth in this quarter.”

Highlights from Q2 2021 include:

- For the three-month period ended June 30, 2021, net revenue grew by 8.5%, (20.9% excluding the impact of foreign exchange) over the comparable prior period, primarily due to increased demand in pre-need property sales, as well as strong sales performance from acquisitions made during the first half of 2021.

- For the three-month period ended June 30, 2021, net revenue growth from comparable business units increased 1.9% (13.1% excluding the impact of foreign exchange), over the three-month period ended June 30, 2020.

- For the three-month period ended June 30, 2021, Adjusted Net Earnings attributable to PLC shareholders grew 22.5%, and Diluted Adjusted Net Earnings per share attributable to PLC shareholders grew 20.7% to $0.356 per share, over the three-month period ended June 30, 2020.

- For the three-month period ended June 30, 2021, Adjusted EBITDA attributable to PLC shareholders grew 16.6%, over the three-month period ended June 30, 2020, to $22.7 million.

- PLC achieved an Adjusted EBITDA margin of 25.8% for the three-month period ended June 30, 2021, an increase of 170 basis points over the three-month period ended June 30, 2020.

- PLC’s consolidated results faced significant headwind from foreign exchange as the average CAD:USD exchange rate decreased 11.3% compared to the three-month period ended June 30, 2020.

- During the quarter, PLC closed three acquisitions in Wisconsin, North Carolina, and Tennessee. The acquisitions consisted of eight funeral homes and six cemeteries complementing PLC’s existing businesses in all three of those markets.

PLC Executes on its Acquisition Growth Initiatives

Subsequent to the quarter’s end, PLC signed a purchase agreement to deepen its presence in the greater Nashville, Tennessee market and closed on a transaction that significantly expanded its existing presence in Mississippi.

The Tennessee businesses are the premier businesses in their respective communities and consist of two on-site funeral home/cemetery properties and further compliment PLC’s footprint in the greater Nashville, Tennessee market. Following the satisfaction of regulatory requirements, the transaction is anticipated to close at the end of August 2021. The Mississippi Businesses consist of one on-site funeral home/cemetery property and ten funeral homes, which both complement PLC’s existing operations in Jackson, as well as represent new expansion into the Gulf Coast market. The Mississippi transaction closed on August 9, 2021.

The combined transactions represent 2,416 calls and 435 interments per year and have been or are expected to be financed with funds from the Company’s credit facility and available cash on hand. Following the closing and integration of the combined businesses from both transactions, the Mississippi and Tennessee Businesses are expected to add approximately US$5.84 million in EBITDA. The agreed upon purchase price multiples for each of these transactions are within PLC’s publicly-stated targeted EBITDA multiple ranges for transactions of this size and nature.

Mr. Green concluded by stating:

“I want to take this opportunity to once again thank our team for their hard work and dedication in serving and providing our client families with a meaningful and respectful way to honor their loved ones. We appreciate each of you and the sacrifices you have made and continue to make throughout this journey.”

Important Reminder

The Company will host a conference call to discuss its Q2 2021 financial results on Friday, August 13, 2021. Details are as follows:

- Date: Friday, August 13, 2021

- Time: 9:30 a.m. EST

- Dial-in Number: Local (416) 764-8659 | Toll Free (888) 664-6392 | Conference ID: 40578021

To ensure your participation, please join approximately five minutes prior to the scheduled start of the conference call. The Company’s complete financial results can be found at www.sedar.com.

A replay of the conference call will be available until August 20, 2021 and can be accessed as follows: Dial-in Number: Local (416) 764-8677 | Toll Free (888) 390-0541 | Conference ID: 578021#. Alternatively, the conference will also be available on the Company’s website at www.parklawncorp.com.

About Park Lawn Corporation

PLC provides goods and services associated with the disposition and memorialization of human remains. Products and services are sold on a pre-planned basis (pre-need) or at the time of a death (at-need). PLC and its subsidiaries own and operate businesses including cemeteries, crematoria, funeral homes, chapels, planning offices and a transfer service. PLC operates in two Canadian provinces and fifteen U.S. states.

Non‐IFRS Measures

Adjusted Net Earnings, Adjusted EBITDA and their related per share amounts, Adjusted EBITDA margins, and net revenue growth from comparable business units (Comparable Operations) are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS. Such measures are presented in this news release because management of PLC believes that such measures are relevant in evaluating PLC’s operating performance. Such measures, as computed by PLC, may differ from similar computations as reported by other similar organizations and, accordingly, may not be comparable to similar measures reported by such other organizations. Please see PLC’s most recent Management’s Discussion and Analysis for how the Company reconciles Adjusted Net Earnings, Adjusted EBITDA and their related per share amount, and Adjusted EBITDA margins to the nearest IFRS measure.

Cautionary Statement Regarding Forward‐Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws relating to the business of PLC and the environment in which it operates. Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “estimate”, “pro-forma” and other similar expressions. These statements are based on PLC’s expectations, estimates, forecasts and projections and include, without limitation, statements regarding: the impact of COVID-19 on the Company’s business; the Company’s belief that in the third and fourth quarters of 2021, the Company will continue to see a lessening effect of COVID-19 on the at-need volume of sales and an increase in demand for both pre-need cemetery and pre-need funeral products throughout most of the markets the Company serves; the Company’s intention to finance the Tennessee Businesses with funds from the Company’s credit facility and cash on hand; the expected timing for closing of the Tennessee acquisition; the expected impact of the Tennessee and Mississippi acquisitions on EBITDA; and that PLC’s performance has moved it closer to achieving its 2022 goals. The forward-looking statements in this news release are based on certain assumptions, including that regulatory restrictions relating to the COVID-19 pandemic in the markets the Company serves will continue to be relaxed through the 2021 calendar year, the Company will be able to complete the pending acquisition in the time period contemplated, recent and pending acquisitions perform as expected, PLC will be able to implement business improvements and achieve costs savings, PLC will be able to retain key personnel, there will be no unexpected expenses occurring as a result of the acquisitions, multiples remain at or below levels paid by PLC for previously announced acquisitions, the CAD to USD exchange rate remains consistent, the acquisition and financing markets remain accessible, capital can be obtained at reasonable costs and PLC’s current business lines operate and obtain synergies as expected, as well as those regarding present and future business strategies, organic growth initiatives, the environment in which the PLC will operate in the future, expected revenues, expansion plans and PLC’s ability to achieve its goals.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, risks associated with the current COVID-19 pandemic and the other factors discussed under the heading “Risk Factors” in PLC’s Annual Information Form and most recent Management’s Discussion and Analysis available at www.sedar.com. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, PLC assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Click Here to View the Q2 2021 Financial Report

Click Here to Listen to the Q2 2021 Earnings Conference Call

Contact Information

Daniel Millett

Chief Financial Officer

(416) 231-1462, ext. 221