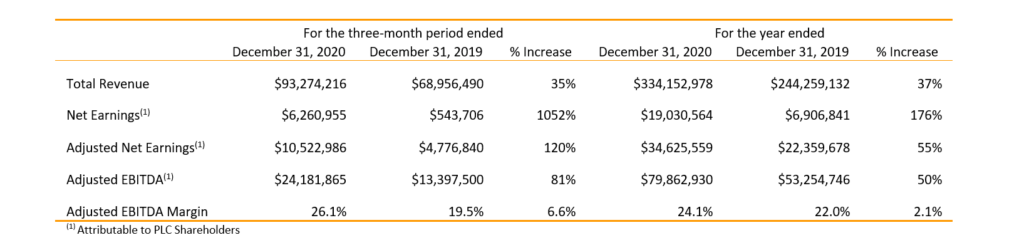

TORONTO, ONTARIO (March 30, 2021) – Today, Park Lawn Corporation (TSX: PLC) (“PLC” or the “Company”) announced its results for the fourth quarter (“Q4”) and year ended December 31, 2020. PLC finished 2020 with a powerful performance in Q4, which included achieving significant growth in revenue, net earnings, Adjusted Net Earnings, Adjusted EBITDA, and Adjusted EBITDA margin:

“Despite the adversities posed by COVID-19, PLC finished the year with the strongest fourth quarter it has seen in its history. Not only did we see a tremendous financial performance with double-digit plus growth across the board, but we also witnessed how the integration of our legacy businesses brought the Company together as one cohesive operating unit. The ability to persevere in 2020’s challenging environment demonstrates not only the capability of our organization but, more importantly, the courage, dedication and commitment of each individual of our team in honorably serving their communities and our families,” stated Brad Green, CEO. Mr. Green continued, “I am immensely proud of our frontline team and grateful for the sacrifices that they made in providing our families with the opportunity to care for their loved ones.”

Highlights from 2020 include:

· For the three-month period and year ended December 31, 2020, revenue grew by approximately 35% and 37%, respectively, over the comparable prior period, primarily due to acquisitions made during 2020 and 2019, as well as increased demand for funeral and cemetery products and services.

· For the three-month period and year ended December 31, 2020, revenue growth from comparable business units was 20.9% and 10.8% respectively.

· Adjusted Net Earnings per share attributable to PLC shareholders was $0.351 and $1.158 for the three-month period and year ended December 31, 2020, respectively, compared to $0.160 and $0.795 for the three-month period and year ended December 31, 2019, respectively.

· For the three-month period and year ended December 31, 2020, Adjusted EBITDA grew 81% and 50%, respectively, over the three-month period and year ended December 31, 2019.

· Park Lawn achieved an Adjusted EBITDA margin of 26.1% and 24.1% for the three-month period and year ended December 31, 2020, respectively, an increase of 6.6% and 2.1% over the three-month period and year ended December 31, 2019.

· On January 31, 2020, the Company completed the acquisition of Family Legacy and Harpeth Hills establishing a strong presence in the middle Tennessee market. The businesses consist of four combination funeral home and cemetery properties, seven stand-alone funeral homes, and two stand-alone cemeteries. The businesses perform approximately 3,000 funeral and 1,000 interments per year.

· In July of 2020, the Company strengthened its balance sheet by successfully completing an $86.3 million Senior Unsecured Debenture Financing. Net proceeds from the financing were used to pay down PLC’s credit facility and create liquidity for future growth. As at December 31, 2020, PLC’s leverage ratio was 1.55 times based on the terms of its credit facility.

· The Company greatly lessened the impact of the COVID-19 pandemic on its business operations by initiating highly effective operational directives to protect the safety and well-being of its team members and the families it serves. Likewise, the Company also implemented new technology and alternative means by which it could effectively meet jurisdictional limitations on gatherings but also provide families with a meaningful way to honor their loved ones.

· Although initially placed on hold as a result of the COVID-19 pandemic, the Company was able to re-engage in its growth initiatives through the strategic acquisition of two businesses in October and November 2020, respectively – Bowers Funeral Service Ltd. (a three location funeral home business in British Columbia) and J.F. Floyd Mortuary, Crematory and Cemeteries (consisting of three combination funeral home and cemetery properties, one stand-alone funeral home, six stand-alone cemeteries and one stand-alone crematory).

· The Company has effectively completed the integration of its legacy acquisitions.

PLC Aggressively Pursues its Growth Targets by Expanding its Presence in Four Key Markets in the U.S.

Prior to the end of Q4 2020, PLC purchased a bolt-on funeral home in Texas, and subsequent to the quarter and year-end, PLC has executed a series of purchase agreements committing to expand its presence in three additional U.S. markets:

Texas

Effective as of December 15, 2020, PLC purchased substantially all of the assets of Winscott Funeral Service Corporation, a single funeral home strategically located in Benbrook, Texas (the “Winscott Business”). The Winscott Business is a bolt-on to PLC’s presence in the Dallas/Fort Worth area.

Wisconsin

Park Lawn has entered into a definitive agreement to purchase substantially all of the assets of Wichmann Funeral Home & Crematory, Inc., BDB Company LLP and 312 Milwaukee Street, LLC in Appleton, Menasha, Kaukauna and Kimberly, Wisconsin (collectively the “Wichmann Businesses”). The Wichmann Businesses consist of five funeral homes, two crematoria and one cremation business which complement PLC’s existing operations in and around the Madison area. Following regulatory approval, the transaction is anticipated to close on March 31, 2021.

North Carolina

PLC has entered into a definitive agreement to purchase substantially all of the assets of West Funeral Home, Inc., West Monument Company and Cemetery, Inc. and Sky View Memorial Park, Inc., in Asheville and Weaverville, North Carolina (collectively the “West Businesses”). The West Businesses consist of one funeral home, three cemeteries and one monument company and complement PLC’s existing North Carolina operations. Following required regulatory approvals, the transaction is anticipated to close towards the end of April 2021.

Tennessee

PLC has entered into a definitive agreement to purchase all of the issued and outstanding membership interests of Cremation Society of Tennessee and Family Care Services, LLC, as well as all of the issued and outstanding stock of Polk Memorial Gardens Corporation and Williams Funeral Home, Inc. with businesses located in Columbia, Mt. Pleasant and Pulaski, Tennessee (collectively the “Williams Businesses”). The Williams Businesses consist of two funeral homes, three cemeteries and one cremation business. The addition of the Williams businesses greatly expands PLC’s presence in the middle Tennessee market which is widely known as one of the fastest growing regions in the United States. Following satisfaction of regulatory requirements, the transaction is anticipated to close at the end of April 2021.

The combined transactions represent 1,659 calls and 456 interments per year and have been or are expected to be financed with funds from the Company’s credit facility and available cash on hand. Once all of these transactions close and the businesses are fully integrated, the combination of the West, Wichmann, Williams and Winscott Businesses are expected to add approximately US$3.6M in EBITDA. The agreed upon purchase price multiples for each of these transactions are within PLC’s publicly-stated targeted EBITDA multiple ranges for transactions of this nature.

Important Reminder

The Company will host a conference call to discuss its 2020 financial results on Wednesday, March 31, 2021. Details are as follows:

- Date: Wednesday, March 31, 2021

- Time: 9:30 a.m. EST

- Dial-in Number: Local (647) 427-7450 | Toll Free (888) 231-8191 | Conference ID: 8367200

To ensure your participation, please join approximately five minutes prior to the scheduled start of the conference call. The Company’s complete financial results can be found at www.sedar.com.

A replay of the conference call will be available until April 7, 2021 and can be accessed as follows: Dial-in Number: Local (416) 849-0833 | Toll Free (855) 859-2056 | Conference ID: 8367200. Alternatively, the conference will also be available on the Company’s website at www.parklawncorp.com.

About Park Lawn Corporation

PLC provides goods and services associated with the disposition and memorialization of human remains. Products and services are sold on a pre-planned basis (pre-need) or at the time of a death (at-need). PLC and its subsidiaries own and operate businesses including cemeteries, crematoria, funeral homes, chapels, planning offices and a transfer service. PLC operates in five Canadian provinces and fifteen U.S. states.

Non‐IFRS Measures

Adjusted Net Earnings, Adjusted EBITDA and their related per share amounts, Adjusted EBITDA margins, and Revenue Growth from Comparable Business Units are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS. Such measures are presented in this news release because management of PLC believes that such measures are relevant in evaluating PLC’s operating performance. Such measures, as computed by PLC, may differ from similar computations as reported by other similar organizations and, accordingly, may not be comparable to similar measures reported by such other organizations. Please see PLC’s most recent Management’s Discussion and Analysis for how the Company reconciles Adjusted Net Earnings, Adjusted EBITDA and their related per share amount, and Adjusted EBITDA margins to the nearest IFRS measure.

Cautionary Statement Regarding Forward‐Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws relating to the business of PLC and the environment in which it operates. Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “estimate”, “pro-forma” and other similar expressions. These statements are based on PLC’s expectations, estimates, forecasts and projections and include, without limitation, statements regarding the impact of COVID-19 on the Company’s business; the Company’s ability to adapt to the current operating environment; the growth targets that PLC aspires to achieve by the end of 2022; the Company’s intention to finance the acquisition of the West, Wichmann and Williams Businesses with funds from the Company’s credit facility and available cash on hand; the expected timing for closing of such acquisitions; and the expected impact of such acquisitions on EBITDA. The forward-looking statements in this news release are based on certain assumptions, including that the Company will be able to complete the pending acquisitions in the time period contemplated, recent and pending acquisitions perform as expected, PLC will be able to implement business improvements and achieve costs savings, PLC will be able to retain key personnel, there will be no unexpected expenses occurring as a result of the acquisitions, multiples remain at or below levels paid by PLC for previously announced acquisitions, the CAD to USD exchange rate remains consistent, the acquisition and financing markets remain accessible, capital can be obtained at reasonable costs and PLC’s current business lines operate and obtain synergies as expected, as well as those regarding present and future business strategies, the environment in which the PLC will operate in the future, any adjustments to operations with the ongoing COVID-19 pandemic, expected revenues, expansion plans and the PLC’s ability to achieve its goals.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, risks associated with the current COVID-19 pandemic and the other factors discussed under the heading “Risk Factors” in PLC’s Annual Information Form and most recent Management’s Discussion and Analysis available at www.sedar.com. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, PLC assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Click Here to Read the Year-End Financial Statements

Click Here to Listen to the Year-End Conference Call

Contact Information

Daniel Millett

Chief Financial Officer

(416) 231-1462, ext. 221